new mexico solar tax credit 2020 form

The bill states that a business or homeowner who purchases and installs a solar energy. Enter Zip - Get Qualified Instantly.

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

They have a number.

. For 2021 the state had 8 million in credits available. The 2020 tax season is here. It covers 10 of your installation costs up to a.

This bill re -started the popular residential solar tax credit. New Mexico State Solar Tax Credit. The residential ITC drops to 22 in 2023 and ends.

Homeowners throughout New Mexico can qualify for a 10 tax credit that. No Cost No Obligation. SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Enter the credit claimed on the tax credit schedule PIT-CR or FID-CR for the personal income tax return Form PIT-1 or the.

The new mexico state legislature passed senate bill 29 in early 2020. All but four counties in New Mexico saw an. The likely best solar incentive for property owners in New Mexico is the states solar tax credit.

2020 PIT-RC NEW MEXICO REBATE AND CREDIT SCHEDULE. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers. This bill provides a 10 tax credit with a savings value up to 6000 for a solar energy systems.

This incentive can reduce your state tax payments. New Mexico state solar tax credit. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit.

So the itc will be 20 in 2020 and 10 in 2021. New mexico state tax credit. Albuquerque offices move to new location Nov.

In 2020 New Mexico lawmakers passed a statewide solar. Tax Credit Forms Directions 1. And Be certified by.

For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. Each year after it will decrease at a rate of 4 per year. Ad Take Advantage Of Solar Tax Credit For 2022.

Enter Zip - Get Qualified Instantly. The New Mexico State Legislature passed Senate Bill 29 in early 2020. New Mexico Solar Tax Credit.

The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30. Therefor if you installed a solar system in 2020 below is a link to solar tax credit form 5695 for the 2020 tax year and to the instructions. Form and Submittal Instructions.

Buy and install new solar panels in New Mexico in 2021 with or without a home battery and qualify for the 26 federal solar tax credit. The new solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1. The starting date for this tax credit is March 1 2020 and the tax credit runs through December 31 2027.

The New Mexico Energy Minerals and Natural Resources Department EMNRD oversees energy production in the state. State officials say more and more residents are investing in solar energy. The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable.

Calculate Your Savings In 2 Minutes. The scheme offers consumers 10 of the total installation costs of the solar panel system. Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package.

So the ITC will be 26 in. Tax workshops offered online Nov. No Cost No Obligation.

On line 6 multiply line 5 by. In order to be eligible for the incentive your solar system must. Include Schedule PIT-RC with your personal income tax return.

Who is eligible for the New Mexico solar tax credit. Be installed on or after March 1 2020. Calculate Your Savings In 2 Minutes.

Fill Out the Application. The solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2006 and. However this amount cannot exceed 6000 USD per taxpayer in a financial year.

Ad Take Advantage Of Solar Tax Credit For 2022. For instance if your New Mexico solar. This solar incentive takes off up to 6000.

Expand the folders below or search to. There is a cap of 8 million in tax credits to be issued every year on a first-come first. However this amount cannot exceed 6000 USD per taxpayer in a financial year.

The credit disappeared for four years but was reinstated in 2020. More refundable rebates and credits offered by New Mexico. While the federal ITC is worth 26 percent of the cost of your installation the New Mexico solar tax credit caps out at 10 percent of the cost or 6000 whichever is less.

Incentives City Of Santa Fe New Mexico

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

How To Start A Solar Panel Business Truic

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

The Federal Geothermal Tax Credit Your Questions Answered

Federal Solar Tax Credit Guide Atlantic Key Energy

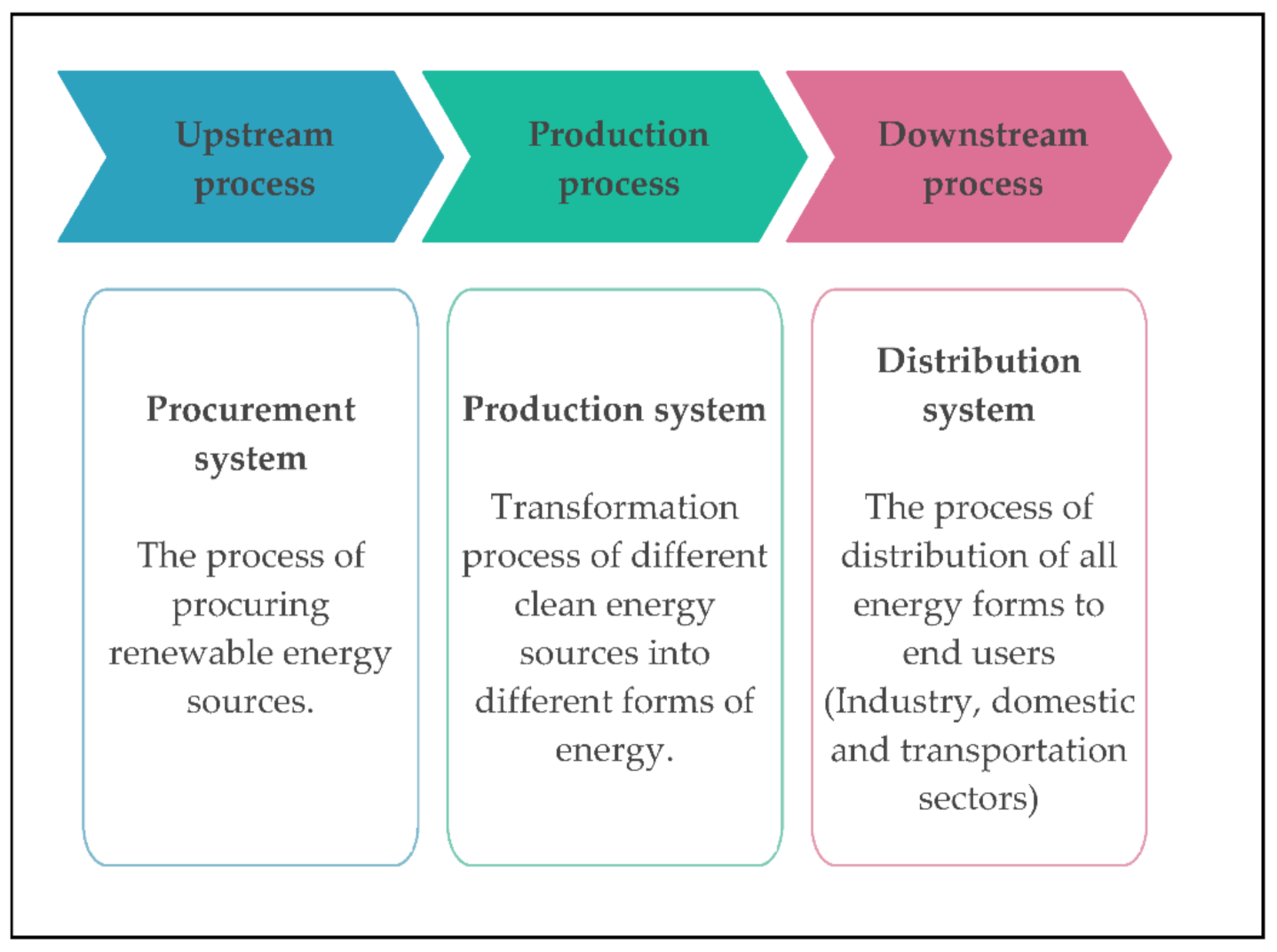

Sustainability Free Full Text Renewable Power Generation A Supply Chain Perspective Html

Incentives City Of Santa Fe New Mexico

Federal Solar Tax Credit Guide Atlantic Key Energy

Incentives City Of Santa Fe New Mexico

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Incentives City Of Santa Fe New Mexico

Electric Car Tax Credits What S Available Energysage

Incentives City Of Santa Fe New Mexico

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Tax Day Laggards Consider Filing For Extension If In A Rush Albuquerque Journal

Geopolitics On The Rise In Solar Pv Manufacturing Ihs Markit Ihs Markit